Sydney Property Market Trends

Sydney Property Market Trends

Sydney’s property market has been marked by a mix of challenges and continued resilience in certain segments in 2024, some of which have given rise to growing trends in the capital.

In terms of property prices, the market has seen a correction this year. While annual growth in 2023 was 11.1%, the latest CoreLogic data reveals that home values rose only 3.3% in the 12 months to November 2024.

The ongoing slowdown in price growth is largely attributed to high interest rates, which continue to suppress demand. Overall median property prices have softened following strong price growth in previous years.

Auction clearance rates have also dipped, with only 54.8% of auctions clearing in mid-December, marking a two-year low.

Despite these challenges, property listings have surged by nearly 10% year-on-year, further weighing on prices.

CoreLogic analysis indicates that Sydney’s housing market is expected to remain under pressure until interest rates are lowered, with financial markets predicting a potential rate cut around April 2025.

Nonetheless, the city’s median dwelling value is still the highest in the country, at $1.197 million.

Luxury Market

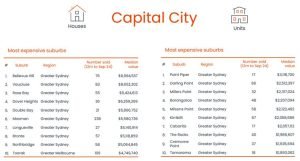

Sydney’s luxury property market continued to dominate in 2024, claiming nine of Australia’s ten highest house price locations and the entire top ten for unit prices.

CoreLogic’s ‘Best of the Best 2024’ report highlighted Bellevue Hill as the priciest suburb, with a median house price of $9.99 million, followed by Vaucluse ($8.65 million) and Rose Bay ($6.42 million).

For units, Point Piper led with a median of $3.119 million, trailed by Darling Point ($2.51 million) and Millers Point ($2.32 million). Sydney also boasted 2024’s three biggest sales, including a $51.5 million property in Wolseley Road, Point Piper.

Shift Towards Apartments

Sydney’s growing house prices and shifting lifestyle preferences are driving a surge in demand for units, with significant changes expected over the next two decades.

According to Domain chief of research and economics Dr Nicola Powell, there has been a 94.3% rise in unit searches over five years as affordability concerns lead buyers to reconsider housing options. Downsizers, drawn to the convenience of apartment living, are a key demographic.

Looking ahead to the next 20 years, she anticipates greater housing diversity, with more Sydney residents living in units, terraces and townhouses.

Outer Suburb Demand

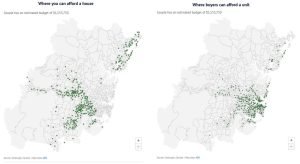

Sydney’s outer suburbs are becoming increasingly popular among home buyers seeking affordability and space. CoreLogic and Canstar data reveals that areas such as Penrith, Liverpool and the Central Coast – averaging 43 kilometres from the city centre – offer house options for buyers with budgets around $1.554 million.

For those considering units, suburbs like Edgecliff, Parramatta and Sutherland provide attractive opportunities closer to the CBD. High-income singles with budgets of $701,000 may explore units in Mount Druitt, St Marys or Fairfield West.

Meanwhile, couples with $1.024 million can opt for houses in Campbelltown or Penrith, or units in Strathfield and Homebush.

Buyer Preferences

Sydney homebuyers are prioritising properties with luxury features like swimming pools, granny flats and waterfront locations, according to Domain.

Keywords such as ‘view’ and ‘penthouse’ remain popular in property searches.

Powell said interest in granny flats surged in 2024, reflecting demand for multigenerational living, additional workspaces or rental income.

Practical features like garages gained popularity, ranking sixth, while searches for ‘study’ dropped to fifth, suggesting fewer people are working from home. Additionally, ‘art deco’ climbed the list, reflecting a renewed interest in vintage design and unique architectural styles. These trends highlight shifting preferences in Sydney’s housing market.

International Appeal

Sydney’s global appeal continues to attract property interest from overseas, with buyers from the United States, New Zealand and the United Kingdom leading the search activity, according to PropTrack senior data analyst Karen Dellow.

Suburbs like Manly, Mosman and the Northern Beaches are highly sought after for their beachside lifestyles and top-tier schools, while areas such as Chatswood, Epping and Castle Hill are also drawing attention.

Sydney’s cosmopolitan vibe, excellent infrastructure and strong job market enhance its desirability. Immigration remains a key driver of demand, enriching Sydney’s cultural fabric and supporting its property market’s growth and innovation.

Countries making the most searches in Sydney:

- United States

- United Kingdom

- New Zealand

- Hong Kong SAR of China

- China

- Singapore

- Philippines

- Canada

- Indonesia

- India

Sydney Luxury Property

Sydney has recorded the fastest annual growth in prime rental prices among 15 global cities, rising 14% over the year to June 2024, according to Knight Frank’s Prime Global Rental Index. Since early 2021, prime rents have surged by 40.9%.

Knight Frank Australia’s chief economist Ben Burston attributes this to strong immigration following the easing of COVID-19 restrictions.

Looking Ahead: 2025 Outlook

Sydney median home prices are forecast to drop by $20,000 to $80,000 in 2025, according to SQM Research’s Housing Boom and Bust report.

This decline, ranging from 1% to 5%, is attributed to ongoing affordability issues and delays in expected interest rate cuts.

SQM director Louis Christopher anticipates that demand will remain subdued due to economic growth slowing, high living costs, and the delay in rate cuts, expected now in May rather than February.

Despite strong population growth and housing shortages, price reductions are occurring in areas like the Inner West and Eastern Suburbs. Christopher predicts a market rebound if rate cuts happen, boosting demand, but warns that without them, the downturn will likely continue. This forecast suggests Sydney’s housing market will start 2025 in decline.

“This may well mean there is a good window for buyers at this time.

If you’re considering entering Sydney’s property market as a first time home buyer, buying an investment property or building an investment portfolio, now may be a strategic time to get expert guidance.

While certain suburbs have been found to offer great opportunities this year for buyers with specific budgets, and particular property types appear likely to become more popular in the years ahead, it’s important to remember that these locations or properties may not align with your individual strategy, goals and budget.

As an expert buyer’s agent in Sydney, BFP Property Group can help you navigate the complexities of Sydney’s market to find the right property for you. Contact us today to discuss how we can tailor a property plan that suits your needs and maximise your investment potential.